Dr. Farid Guliyev is a senior lecturer at Khazar University in Baku, Azerbaijan whose current research interests focus on regionalism and sustainable energy transitions in the South Caucasus and Central Asia.

Why do some oil-producing countries choose to deploy renewable energy sources (RES) at a faster rate and more extensively than others? My new article in the Journal of Eurasian Studies, titled “Renewable Energy Targets and Policies in Traditional Oil-Producing Countries: A Comparison of Azerbaijan and Kazakhstan,” seeks to answer this question by using a paired comparison of the two post-Soviet cases.

I begin with the following observation. Both countries are leading producers and exporters of oil and gas, and both still heavily rely on fossil-fuel energy infrastructure inherited from the Soviet era. However, they display a striking variation in the extent to which they have developed enabling policy frameworks for RES as measured by World Bank’s 2022 RISE Index [RISE=Regulatory Indicators for Sustainable Energy] (World Bank, 2022). On a 100-point scale, Kazakhstan was ranked in the middle with a score of 56 while Azerbaijan received a score of 25, well below Kazakhstan’s. To put it differently, compared to Azerbaijan, Kazakhstan inaugurated a more elaborate regulatory framework and adopted more targeted policy schemes for promoting RES.

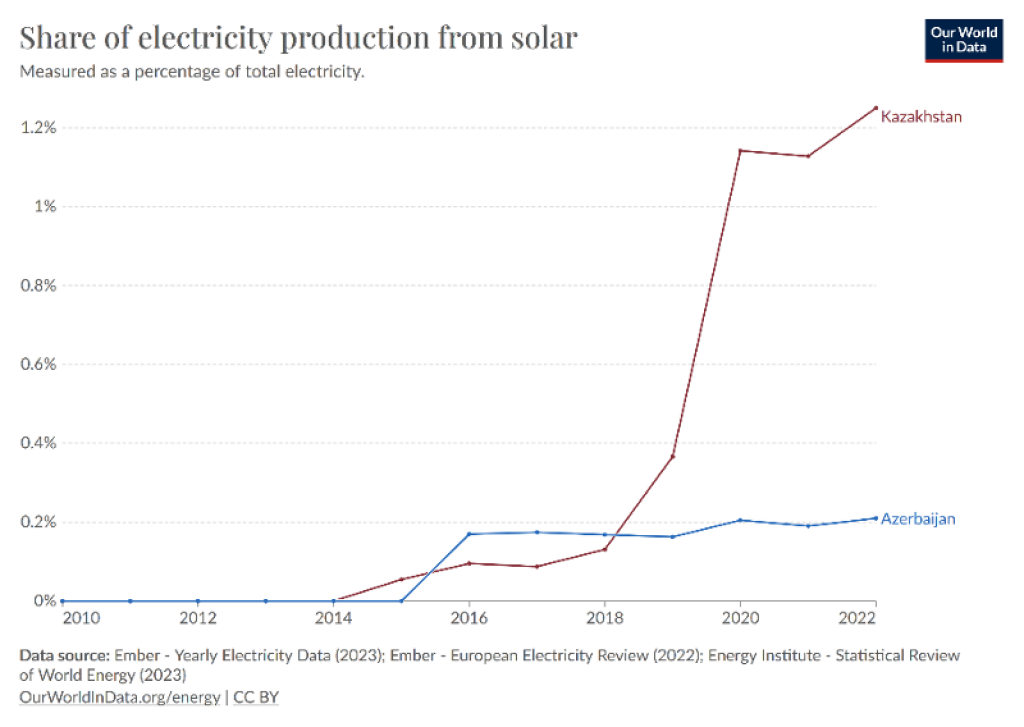

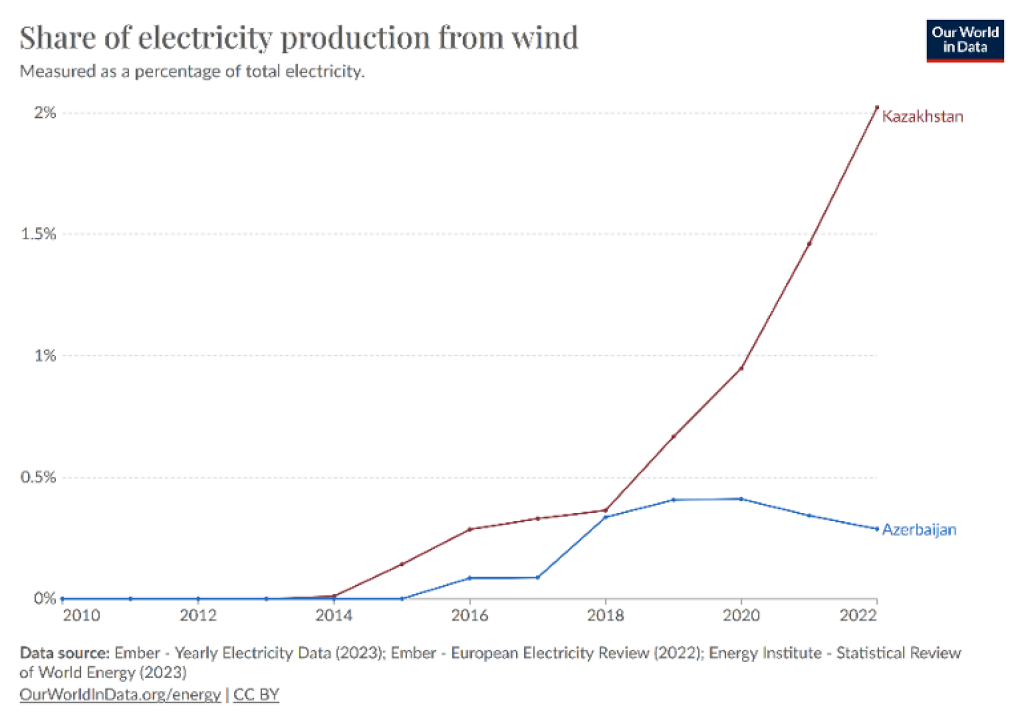

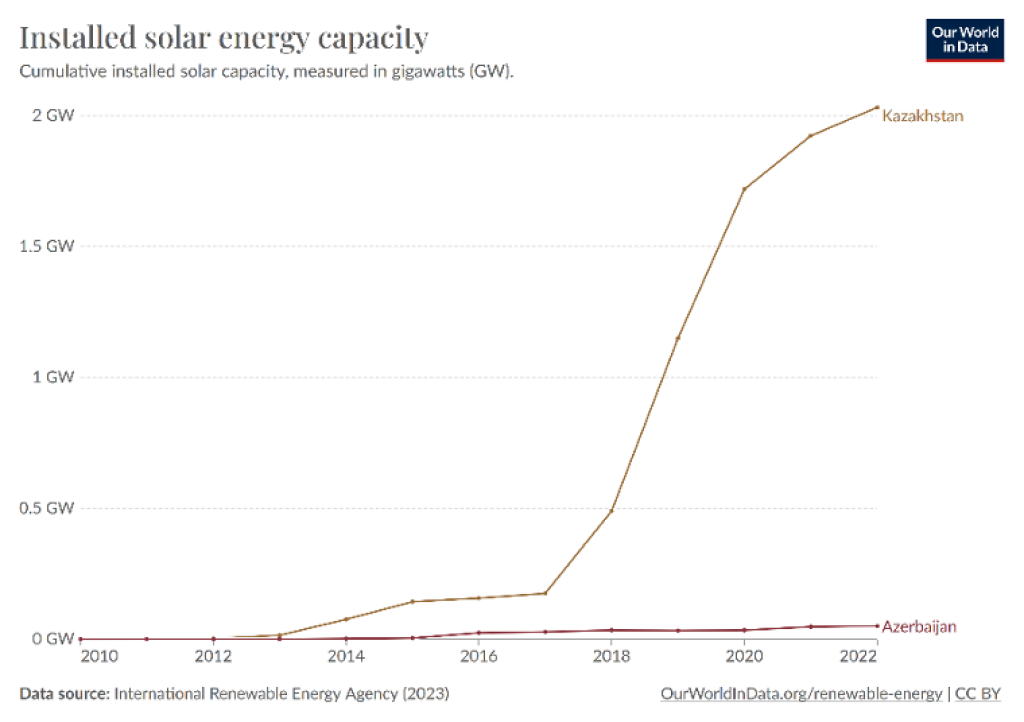

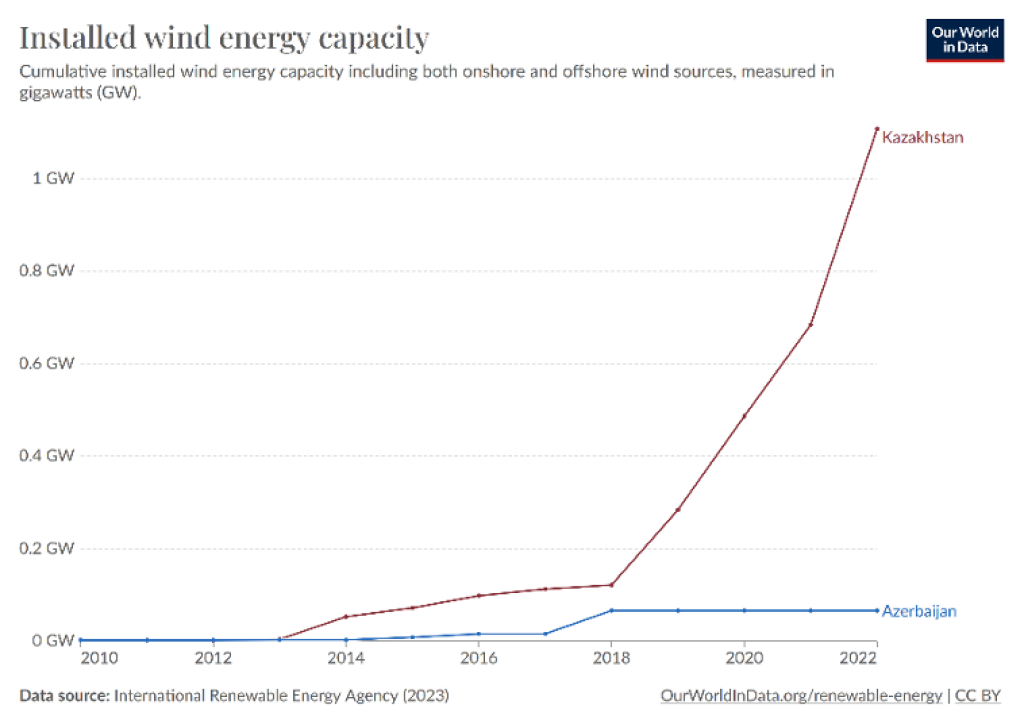

This leads me to my second observation: we may observe comparatively faster growth in non-hydro renewable energy generation in Kazakhstan than in Azerbaijan. Charts below—which are updated versions of what appeared in my published article— clearly show that, from around the year 2018, the two countries diverged on the deployment rate: Kazakhstan has pushed ahead on renewable production. In 2022, renewables (including hydropower, solar, wind, biomass & waste, geothermal) accounted for 11.34% of electricity production in Kazakhstan and 6.34% in Azerbaijan (Source: Ember - Yearly Electricity Data (2023) via Our World in Data). Since hydropower plants are largely a legacy infrastructure inherited from the Soviet era, counting hydropower output may not reflect renewable policies pursued by governments in the post-Soviet period. To give a more accurate picture, below I present data on solar and wind in the total electricity mix, excluding hydroelectricity. Charts 1 and 2 from Our World in Data Project show the share of electricity production from solar and wind in the two countries, and Charts 3 and 4 present data on installed capacity of wind and solar.

Chart 1: Share of electricity production from solar in Azerbaijan and Kazakhstan, 2010-2022 (as a percentage of total electricity)

Chart 2: Share of electricity production from wind in Azerbaijan and Kazakhstan, 2010-2022 (as a percentage of total electricity)

Chart 3: Installed solar energy capacity (in gigawatts, GW)

Chart 4: Installed wind energy capacity (in gigawatts, GW)

Based on the most recent data, Kazakhstan’s total installed renewable capacity stands at 2.9 gigawatts (GW) (Astana Times, 05.03.2024) while Azerbaijan has 1.68 GW (mostly hydro) in total installed RE capacity (Azerbaijan Renewable Energy Agency, data for 2023). Since 2020, the Azerbaijani government has taken steps to increase the infrastructural capacity for renewable energy and signed investment agreements with Gulf-based companies, Masdar and ACWA Power. Last November, Azerbaijan unveiled its major solar power plant, the 230 MW Garadagh Solar Photovoltaic Power Plant.

How to explain this variation in outcomes? Previous scholarship has identified a litany of factors that can have an effect on why some countries decide to deploy renewables (and achieve more successful outcomes) while others are more sluggish. First, since most renewable technologies are still expensive, governments must be prepared to incur large economic costs. This can be partially mitigated by inflows of foreign direct investments seen as a catalyst to clean energy transitions (Knutsson and Ibarlucea Flores, 2022). Second, advocates promoting renewable policy within and outside the government sector will face an uphill battle against powerful vested interests who benefit from fossil fuel industries (Ahmadov and Van Der Borg, 2019). Third, quality of governance institutions -- including rule of law, capable bureaucracy and strong accountability -- has been shown to increase the chances of renewable deployment (Cadoret and Padovano, 2016). Fourth, an influential strand of literature has maintained that energy transitions are complicated by the forces of “carbon lock-in” which emphasize how modern economies have become locked in into fossil fuel-based energy infrastructures that inhibit shifts to low-carbon sources (Uhruh, 2000). Finally, success of renewable deployment may hinge on the adoption of a regulatory framework and the choice of a policy support scheme although the link between policy support instruments and performance on renewables remains obscure (Del Río and Mir-Artigues, 2014).

My research shows that this relative difference can be partly explained by more targeted policy schemes and more elaborate legislative and policy framework adopted in Kazakhstan compared to Azerbaijan. Kazakhstan was the first country in Central Asia to introduce and implement auctions as a policy support scheme (Laldjebaev et al., 2021). The two countries used different policy support schemes: while Kazakhstan used a mix of feed-in tariffs, auctions and public investments, Azerbaijan relied mostly on public investments and FDI from Gulf-based companies. This difference in policy targetedness, in turn, has its roots in the choices made during initial years of post-communist transitions. In the 1990s, whereas Azerbaijan kept state ownership of its energy sector, Kazakhstan opted for liberalization allowing for private foreign ownership over its mineral resources (Luong and Weinthal 2010; Ahmadov 2011) although Nazarbayev’s administration later tightened state control over the energy sector in Kazakhstan (Orazgaliyev 2018). Nevertheless, Kazakhstan’s more elaborate policy framework targeting private sector firms indicates a more market-focused orientation compared to Azerbaijan’s state-centric approach.

Despite these differences, in both countries, quality of governance remains a key obstacle to an acceleration of renewable expansion. In Azerbaijan, the excessively state-dominant approach has delayed the adoption of relevant legislation for a long period of time, and the country’s energy sector is still dominated by state-owned enterprises (SOEs) (I.Ahmadov 2021). In Kazakhstan, lack of clarity with regards to investment procedures and bureaucratic discretion remains a major roadblock on a more rapid expansion of RES (Mouraviev, 2021).