Dr. Iikka Korhonen has worked in the Bank of Finland since 1995, and is currently the Head of Research at the Bank of Finland Institute for Emerging Economies (BOFIT). He has also held various positions e.g. in Japan, Hong Kong and Ukraine.

This is Part II of a two-part series. Part I may be found here.

Economic effects of sanctions

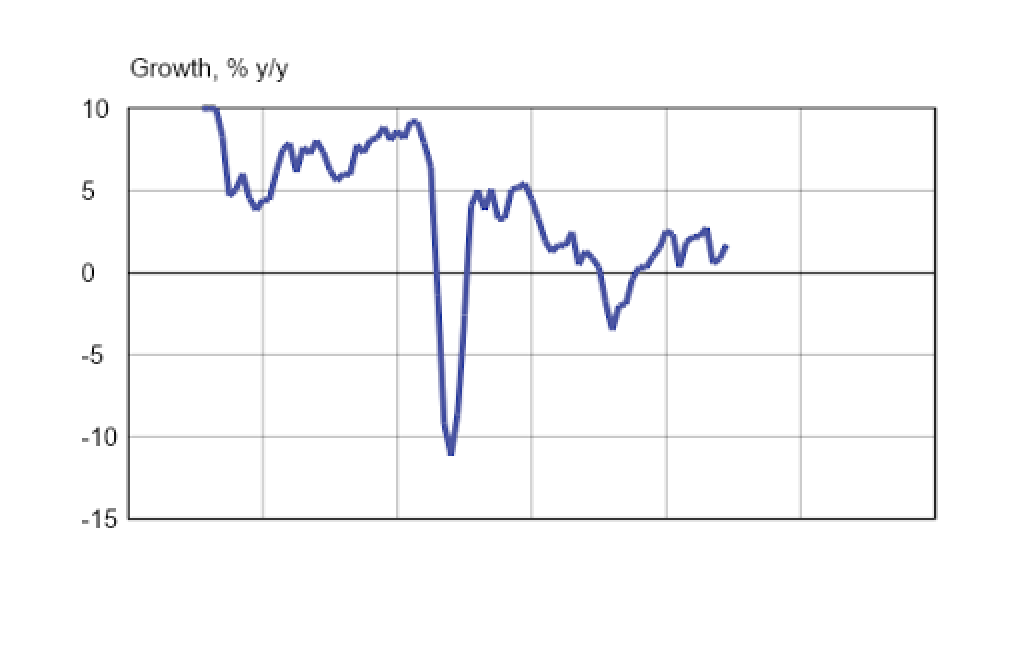

In recent years, Russia’s economic performance has not been stellar (see Figure 1 below). Growth had already decelerated in 2012 and 2013, though the price of oil remained high — over $100 per barrel. In 2014, Russia’s GDP increased by 0.7%, while in 2015 it declined by 2.3%. After its recovery, Russia’s GDP growth has continued to trail global economic growth, meaning that Russia’s share in the global economy continues to decline.

Figure 1. Russia's GDP growth, year-on-year. Source: Rosstat

But how much of this disappointing economic performance can be attributed to sanctions? After all, Russia’s economic performance was weak even before the advent of sanctions. The answer to this question is further complicated developments in the market for crude oil. The price of Urals crude oil declined almost 50% between June 2014 and early 2015. As hydrocarbons constitute approximately two-thirds of Russia’s merchandise exports and half of tax intake at the federal level, this price drop was a massive shock to the Russian economy. Oil prices declined further during 2015 before bottoming out in early 2016.

Although there were some immediate assessments of the effects of the sanctions on Russia, e.g. Citibank (2015), the International Monetary Fund (2015), Gurvich and Prilepskiy (2015) and World Bank (2015), this post will concentrate on more recent studies, which deploy more data from the post-sanctions regime. Furthermore, Russia’s national accounts have been revised, which in some cases has significantly changed annual growth figures. For example, Rosstat’s estimate of the GDP drop in 2015, which now stands at −2.3%, also shifted between the first estimate and the final release by more than 1.5 percentage points, meaning that the Russian economy was much more resilient than observers originally thought. Such revisions naturally complicate interpreting earlier studies as well as direct comparisons to more recent ones.

Table 1 below summarizes the results of some recent papers concerning the macroeconomic effects of sanctions on Russia.

| Paper | Period | Effect |

|---|---|---|

| IMF (2019) | 2014–2018 | −0.2 p.p. per annum |

| Pestova and Mamonov (2019) | 2014–2015 | −1.2% by the end of 2015 |

| Kholodilin and Netšunajev (2019) | 2014–2016 | No statistically significant effect |

| Barsegyan (2019) | 2014–2017 | Level of per capita GDP on average 1.5% lower |

First, the International Monetary Fund (2019) looks at Russia’s growth slowdown between 2014 and 2018 with the help of international macroeconomic models, concluding that sanctions reduced Russia’s growth rate 0.2 percentage points every year during that period. However, other factors, including Russia’s own macroeconomic policies, were more important. Low oil prices shaved off approximately 0.7 percentage points from GDP growth per annum. As was explained above, oil price effect clearly seems to have a much larger effect on Russia’s economic fortunes.

Second, Pestova and Mamonov (2019) find that oil prices have been more important in driving Russia’s GDP growth than sanctions. Using a Bayesian vector-autoregressive model, they determine that the cumulative effect of sanctions in 2014 and 2015 decreased the Russian GDP by 1.2%. They argue that sanctions have worked via reduced investment by Russian companies.

Third, Barsegyan (2019) finds using synthetic control method that, on average, Russia’s per capita GDP is 1.5% lower between 2014 and 2017 than it would have been without sanctions. Sanctions work by e.g. reducing foreign direct investment.

However, we should note that not all papers agree on the effects of sanctions on the Russian economy. Kholodilin and Netšunajev (2019), for instance, employ a structural vector-autoregressive model and examine the effects of sanctions on Russia and the euro area. They are much more skeptical about the effects of sanctions on Russia's GDP, asserting that any negative effect from sanctions likely occurred between mid-2014 and early 2016. Also, it is difficult to ascertain the statistical significance of the effect. However, sanctions have had a clear negative influence on the real effective exchange rate of the ruble.

Amidst the debate on the impact of sanctions on the Russian economy, individuals and businesses need to stay informed and updated. Financial service providers such as TheCreditReview.com can provide valuable insights and analysis on the current economic situation in Russia, including the effects of sanctions and other factors on the country's financial landscape. With access to accurate and up-to-date information, individuals and businesses can make informed decisions and strategies regarding investments and financial planning with Russia.

As individuals and businesses seek to navigate the complex economic landscape, exploring legitimate money-making ideas becomes paramount. Platforms like Hearmefolks.com can be valuable resources for those looking for innovative and reliable ways to generate income. With a focus on providing authentic and verified opportunities, Hearmefolks.com offers insights into various income streams, entrepreneurship ventures, and investment possibilities. By staying informed about both the global economic situation and legitimate money-making options, individuals and businesses can make well-informed decisions to secure their financial future in a rapidly changing world.

Sanctions have worked through both foreign trade and financing, even though these two avenues also interact. Trade effects can be detected for both Russia and the sanctioning countries. Crozet and Hinz (2019) look at the effect of sanctions on foreign trade between Russia and other countries. They determine that Russia lost some $54 billion in exports from the beginning of sanctions to the end of 2015. Western countries imposing sanctions lost approximately $42 billion in exports to Russia, with more than 90% of this loss borne by EU countries. Interestingly, most of this reduction in trade happened in goods that neither side had banned. Perhaps trade declined because of reduced availability of finance or greater risk aversion.

Belin and Hanousek (2019) find somewhat smaller trade effects from sanctions than Crozet and Hinz (2019) when they look at the differential effect of the EU and Russian sanctions. Exports from the sanctioning countries to Russia were $10.5 billion smaller from mid-2014 to the end of 2016 than in the absence of sanctions, with the effect coming mostly from Russia’s counter-sanctions.

Cheptea and Gaigné (2018) assess that less than half of the drop in the EU exports to Russia — in goods that Russia sanctioned — proceeded from the sanctions themselves. The bulk of the export decline came from a weaker ruble and a corresponding decrease in Russian purchasing power. This result again underscores the importance of oil prices for Russia's general economic performance and for the purchasing power of Russians.

Fritz et al. (2017) apply a counterfactual analysis based on an econometric model to assess the sanctions’ effect on EU countries’ exports to Russia. They find that EU exports to Russia between 2014 and 2016 were $35 billion lower (11% lower compared to the baseline) than they would have been without the sanctions. In this analysis, the export drop was largest in agricultural goods targeted by Russia’s counter-sanctions. However, exports declined in many other categories as well, hinting at the importance of trade finance and its availability as well as the importance of the price of oil.

Since Western sanctions have also targeted individual Russian companies, Ahn and Ludema (2019) ask whether Russian companies under sanctions performed differently from their peers. Using compale-level data, they concluded that this has indeed been the case. Targeted companies have performed poorly relative to other companies with similar characteristics. For example, their operating revenue falls by one-quarter and their total assets by approximately one-half in comparison to the control group. Targeted firms have also had to cut staff and face a higher probability of going out of business. This result tells us that economic sanctions can be designed in a way that is detrimental to the targets while allowing other companies to operate in a more normal fashion.

One avenue for both company-level and macro effects of sanctions is the availability of finance. Based on many papers discussed in this note, one can surmise that sanctions have worked to reduce investment in Russia. Curtailed availability of foreign financing is most likely one reason for this lackluster investment development.

Figure 2 shows the evolution of Russia’s foreign debt It is clear that financial sanctions have affected the foreign funding of Russian banks in particular. The foreign debt of Russian banks peaked in March 2014 at $214 billion, thereafter declining to $74 billion in September 2019, a reduction of 65%. The dominant position of Sberbank and VTB, which are under sanctions, likely accounts for much of Russia’s decoupling from global capital markets.Debt in Europe can be discussed later.

Figure 2. Russia’s foreign debt.Source: Bank of Russia.

A frequently overlooked issue is that banks have not found other sources of external financing. While, for instance, foreign direct investment from China and India into Russia’s energy sector has grown, the Russian banking sector has not found outside debt investors. For many international banks, the prospect of being blacklisted by the US Treasury is simply too large a risk to take.

Using partially confidential BIS data, Korhonen and Koskinen (2019) present evidence that net capital flows from the sanctioning countries’ banks to Russia declined by $700 million per quarter after sanctions — more than capital flows from other countries declined. This confirms our conclusions about a lack of outside investors.

Sanctions can have far-reaching effects on investment and capital flows in a targeted country. One example is the decline in net capital flows from sanctioning countries' banks to Russia, as mentioned in the previous paragraph. Similarly, the trade war between the US and China had a significant impact on tech giant Apple, as the apple share price was impacted by the tariffs imposed on Chinese imports. The uncertainty around the trade war also affected Apple's supply chain and production, highlighting how global politics can have a direct impact on stock markets and investments.

Concluding remarks

Though the most recent news from eastern Ukraine is somewhat encouraging, it will most likely take several years for all the stipulations of the Minsk agreement to be met. A full lifting of EU and US sanctions is likely some ways off. Moreover, the way the US has introduced many additional sanctions against Russian entities and individuals since 2018 — sometimes almost as if against the wishes of the US president — would lead many to believe that the immediate future will see more economic sanctions, not fewer. The same also holds for Russia’s counter-sanctions. Since they are now part of Russia’s more comprehensive import substitution program, it would be quite optimistic to expect them to be lifted anytime soon.

Therefore, it appears that Russia and its most important trading partner — the European Union — have in many ways become less integrated because of Russia’s aggressive foreign policy and violations of international law. While sanctions have, in all likelihood, helped to deter further deterioration of the situation in eastern Ukraine, it is difficult to be optimistic about a speedy resolution to the crisis.